process payroll with ease

Whether you are a payroll professional or new to payroll, we can guide you through the process effortlessly. As employees log hours, request time off, or undergo open enrollment, our platform automatically updates accordingly. It’s reliable, precise, and flexible.

key payroll features

A Single Platform

Manage your payroll on a single platform. Any changes you make in payroll will be reflected across the platform.

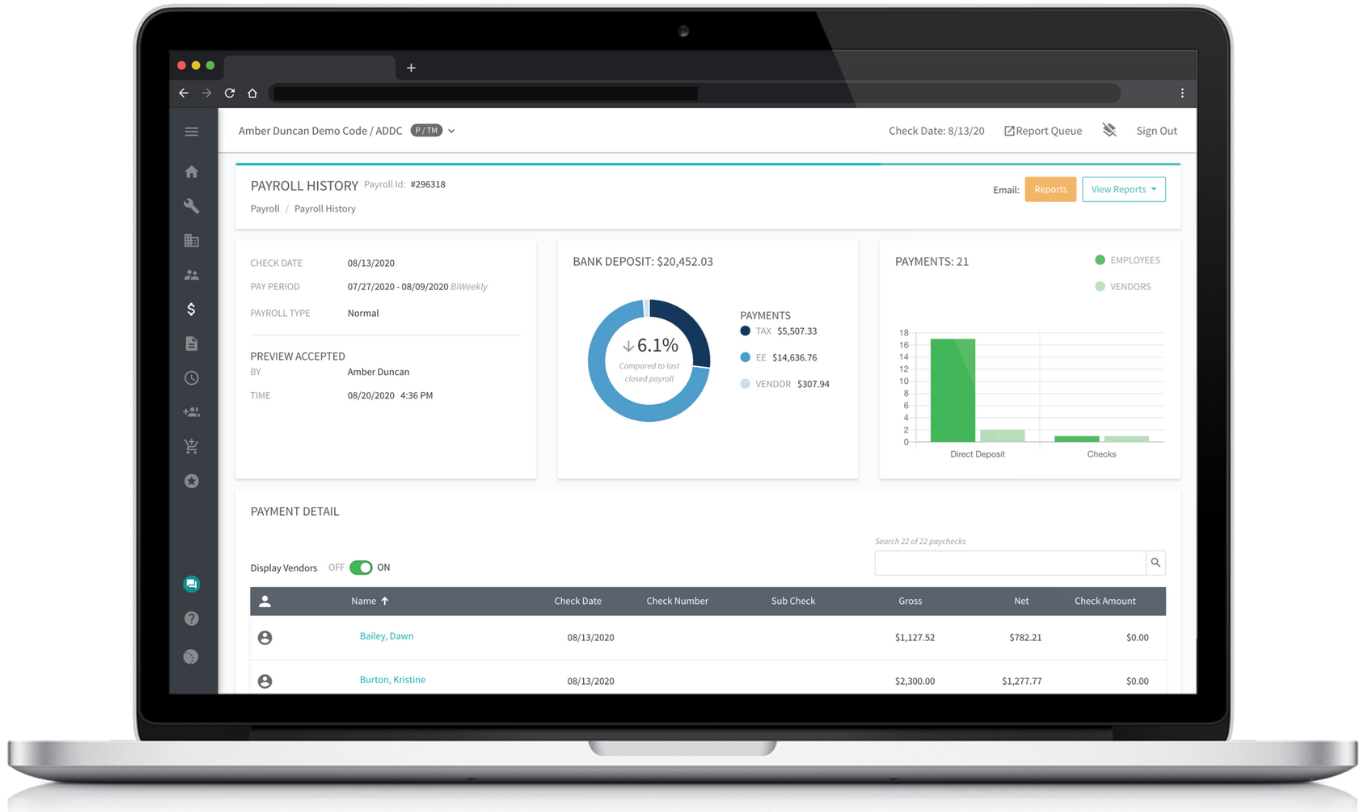

Robust Reports

We offer a number of reports, such as payroll history, bank transactions, overtime, and more. Gain real, actionable insight into your organization with our standard and custom report writer as well as our dashboards.

Preview Your Payroll

Prior to accepting payroll, you’ll receive a preview that allows you to review all deductions, reports, and check stubs, and make any last minute adjustments.

Automatic Tax Filing

Upon accepting your payroll preview, your tax payments will be sent on their proper due dates. There is no need to worry about any local, state, and federal taxes.